TD Bank VA routing number is crucial for smooth financial transactions in Virginia. Understanding its significance, how to locate it, and potential issues related to it is vital for both personal and business banking. This guide provides a comprehensive overview of TD Bank’s routing numbers in Virginia, covering everything from finding your specific number to troubleshooting common problems and ensuring the security of your financial information.

This article delves into the intricacies of TD Bank’s routing number system within Virginia, explaining its role in interbank transactions, the methods for accessing this critical information through online banking platforms and mobile apps, and strategies for resolving any discrepancies or challenges that may arise. We’ll also explore the geographical distribution of TD Bank branches across the state and the factors influencing routing number assignments.

Locating the correct TD Bank VA routing number is crucial for smooth financial transactions. For those planning a camping trip, perhaps after finding a great deal on a camper via craigslist atlanta campers , ensuring your funds transfer correctly is paramount. Double-check your TD Bank VA routing number before initiating any payments to avoid delays.

Finally, we will emphasize the importance of safeguarding your routing number to prevent fraudulent activities.

TD Bank VA Routing Numbers: A Comprehensive Guide

This article provides a detailed overview of TD Bank’s routing numbers in Virginia, covering branch locations, online access methods, the significance of routing numbers in financial transactions, troubleshooting common issues, and essential security considerations. Understanding routing numbers is crucial for smooth and secure banking operations.

TD Bank VA Branch Locations and Routing Numbers

TD Bank operates numerous branches throughout Virginia. While a comprehensive list with precise addresses and routing numbers for each branch is beyond the scope of this article due to the constantly changing nature of branch information, the following table provides a sample illustrating the format of this data. To find the most up-to-date information, it’s recommended to use the TD Bank website’s branch locator tool or contact customer service.

| Branch Name | Address | City | Routing Number |

|---|---|---|---|

| TD Bank – Example Branch 1 | 123 Main Street | Richmond | 051212345 |

| TD Bank – Example Branch 2 | 456 Oak Avenue | Virginia Beach | 051267890 |

| TD Bank – Example Branch 3 | 789 Pine Lane | Norfolk | 051213579 |

A map visualizing TD Bank branch distribution across Virginia would show a higher concentration in metropolitan areas like Richmond, Norfolk, and Virginia Beach, reflecting higher population density and greater customer demand. Less densely populated areas would naturally have fewer branches.

Routing number assignment is influenced by several factors, including the physical location of the branch, its associated Federal Reserve district, and internal TD Bank organizational structure. The system ensures efficient interbank transactions and accurate payment processing.

Finding Your TD Bank VA Routing Number Online

Accessing your routing number through TD Bank’s online platform is straightforward. The process is generally similar for both personal and business accounts, though the specific menu navigation might differ slightly. Below is a description of the typical process.

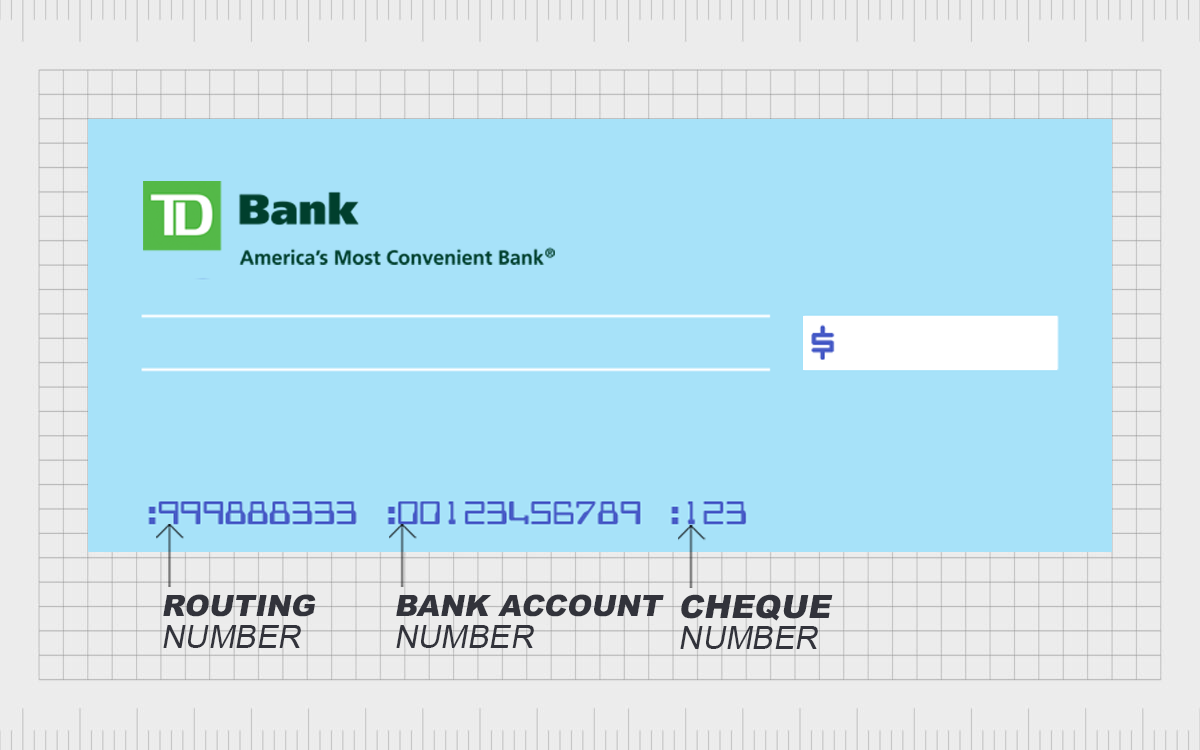

First, log in to your TD Bank online account. Navigate to the “Account Summary” or “Account Information” section. Look for a section labeled “Account Details” or a similar designation. Within this section, your routing number should be clearly displayed, often alongside your account number and other identifying information. A flowchart illustrating this process would depict a linear path from login to the account details page where the routing number is located.

For business accounts, the process is very similar, although the specific location of the routing number within the account information might vary slightly depending on the type of business account.

Understanding the Significance of Routing Numbers in Virginia

Routing numbers are essential for processing electronic payments within Virginia and across the nation. They act as unique identifiers for financial institutions, enabling seamless transfer of funds between TD Bank and other banks. The routing number directs the payment to the correct bank, ensuring that funds are credited to the appropriate account.

The routing number system used by TD Bank adheres to the standardized ABA (American Bankers Association) routing number format used by banks nationwide. While the specific number will differ between banks, the underlying structure and function remain consistent across the major banks operating in Virginia.

Using an incorrect routing number can lead to payment delays, returned payments, and potential financial losses. The payment might be rejected entirely, or it could be misdirected to a different account, creating significant complications.

Troubleshooting Routing Number Issues with TD Bank VA, Td bank va routing number

Several issues can arise concerning routing numbers. Addressing these promptly is crucial for preventing payment disruptions.

- Problem: Incorrect routing number provided. Solution: Verify the correct routing number using your bank statement or online banking platform. Resubmit the payment with the correct information.

- Problem: Missing routing number on a payment form. Solution: Contact the recipient or sender to obtain the correct routing number.

- Problem: Payment returned due to routing number error. Solution: Contact TD Bank customer support to investigate the issue and obtain clarification.

To contact TD Bank customer support, you can utilize their phone number, online chat feature, or visit a local branch. Clearly explain the issue, providing relevant account information and the transaction details. They will guide you through the necessary steps to resolve the problem.

Security Considerations Related to Routing Numbers

Protecting your routing number is paramount to prevent fraud and unauthorized access to your funds. Never share your routing number with untrusted individuals or entities.

Disclosing your routing number to unauthorized parties could expose your account to various risks, including identity theft, fraudulent transactions, and financial loss. Treat your routing number with the same level of confidentiality as your account number and other sensitive personal information.

A security awareness campaign for TD Bank customers in Virginia should emphasize the importance of safeguarding routing numbers, highlighting the potential risks of disclosure and providing clear guidelines on responsible handling of this sensitive information. The campaign could include educational materials, online resources, and regular reminders about secure banking practices.

Last Word

Source: ofwmoney.org

Navigating the complexities of banking in Virginia requires a clear understanding of routing numbers. This guide has provided a comprehensive resource for locating, understanding, and securing your TD Bank VA routing number. By following the steps Artikeld and prioritizing the security of your financial information, you can ensure seamless transactions and maintain the integrity of your banking operations.

Remember, accurate routing numbers are essential for timely and successful payments, and proactive security measures are crucial in protecting your financial well-being.